6 Best Accounting Software

Table of Contents

ToggleBest Accounting Software for small businesses

Running a small business comes with its own set of challenges, and one of the crucial aspects is managing finances effectively. Manual bookkeeping and spreadsheets can be time-consuming and prone to errors. That’s where accounting software comes to the rescue. The best accounting software for small businesses automates financial processes, streamlines bookkeeping tasks, and provides valuable insights into your business’s financial health.

In this blog, we will review the best accounting software for small businesses in UK 2023. As every successful business knows, efficient financial management is key to achieving growth and profitability. In this blog, we have conducted an in-depth analysis, comparing and contrasting several popular accounting software solutions available in the market. After careful evaluation, one software stood out as the clear winner, offering small businesses unparalleled features and functionality.

Importance of Accounting Software for Small Businesses

Accounting software plays a pivotal role in the success of small businesses. It helps in maintaining accurate financial records, generating invoices, tracking expenses, managing cash flow, and preparing financial reports. By automating these processes, business owners can save time, reduce errors, and focus on growing their businesses.

Additionally, accounting software provides real-time visibility into financial data, enabling business owners to make informed decisions based on accurate and up-to-date information. It also facilitates better financial planning and forecasting by generating insightful reports and analyses. Moreover, these software solutions help ensure compliance with tax regulations and reduce the risk of errors and financial discrepancies. Ultimately, accounting software empowers small businesses to improve productivity, optimize financial management, and drive overall success.

Advantages of Using Accounting Software

Using the best accounting software for small businesses in UK 2023 offers numerous advantages:

Better Financial Insights: Access to real-time financial reports helps in making informed business decisions and tracking performance.

Enhanced Efficiency and Time Savings: Accounting software automates repetitive tasks, such as data entry, invoice generation, and financial reporting. Streamlining these processes saves valuable time and allows small business owners to focus on core business activities.

Streamlined Invoicing and Cash Flow Management: Accounting software simplifies the invoicing process by automating the creation and delivery of invoices to clients. It also enables easy tracking of payments and overdue invoices, helping businesses manage their cash flow effectively.

Better Compliance and Tax Management: Accounting software often incorporates tax rules and regulations, ensuring businesses stay compliant with tax laws. It automates tax calculations, generates accurate tax reports, and helps in submitting tax returns on time. This reduces the risk of penalties and ensures smooth tax compliance.

Integration with Other Business Tools: Accounting software often integrates with other essential business tools, such as customer relationship management (CRM), project management, or e-commerce platforms. This integration streamlines data flow, eliminates duplicate entries, and provides a unified view of the business.

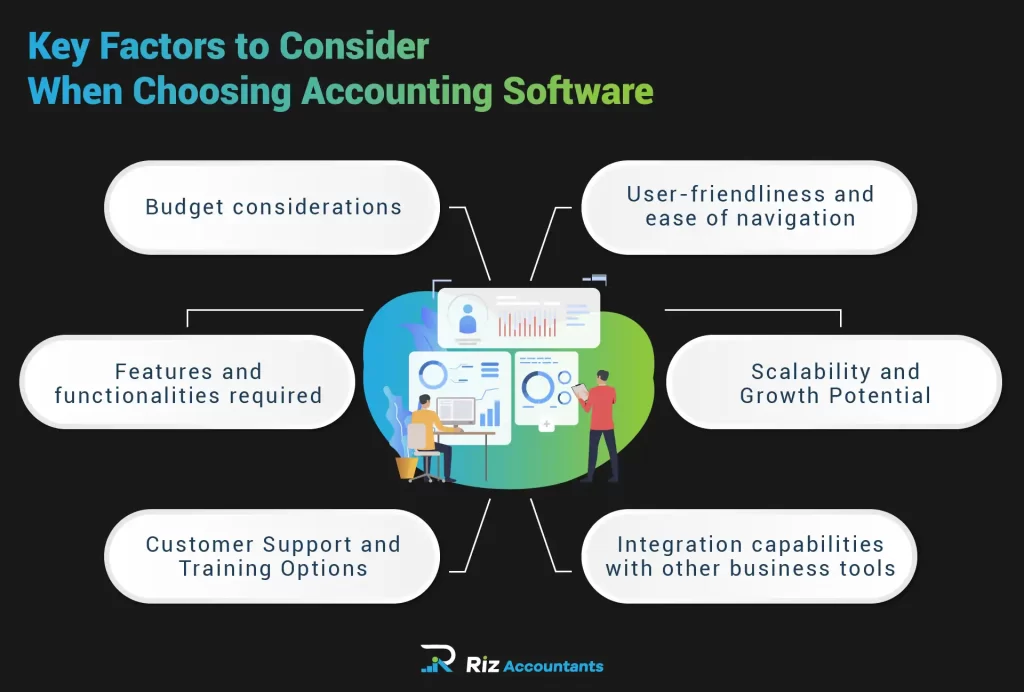

Key Factors to Consider When Choosing Accounting Software

Before diving into the details of the best accounting software for small businesses in UK 2023, these factors can help you narrow down your options and find a software solution that aligns with your specific needs and budget. Let’s explore each factor in detail:

Budget considerations

Budget is an important consideration for small businesses, and it’s crucial to find best accounting software for small businesses that offer the right balance between affordability and functionality. Consider the cost of the software, including any upfront fees, monthly or annual subscription costs, and additional charges for extra features or user licenses. Look for software options that provide value for money and offer a range of pricing plans to suit different business sizes and budgets.

When researching accounting software, keep in mind that the best accounting software for small businesses doesn’t necessarily mean the most expensive option. Look for software that offers the necessary features and functionalities within your budget, ensuring it meets your business’s accounting needs without straining your finances.

User-friendliness and ease of navigation

Small business owners and their teams need to quickly adapt to new software and easily navigate its features. Look for accounting software that is user-friendly and intuitive, with a clean and organized interface. The software should be easy to set up and use, even for individuals without a strong accounting background.

Features and functionalities required

The best accounting software for small businesses is one that meets your specific accounting needs. Identify the key features and functionalities that are essential for your business operations. Identify your specific accounting needs and prioritize the features that are crucial for your business. This will help you find the “best accounting software for small businesses” that aligns with your requirements.

Scalability and Growth Potential

When selecting best accounting software for small businesses, it’s important to consider its scalability and growth potential. You want a software solution that can accommodate your business’s future needs as it expands. Look for software that offers additional features and options as your business grows, such as advanced reporting capabilities, multi-user access, and the ability to handle increased transaction volumes.

Customer Support and Training Options

Adequate customer support and training options are crucial for a positive experience with accounting software. Ensure that the software provider offers reliable customer support channels such as phone, email, or live chat. Additionally, check if they provide training resources like user guides, video tutorials, or webinars to help you and your team get up to speed with the software quickly. Good support and training can prevent roadblocks and assist in resolving issues promptly.

Integration capabilities with other business tools

Small firms generally utilize various tools and systems to handle different elements of their operations. Accounting software and other business tools, such as customer relationship management, project management, e-commerce platforms, or payroll systems, require integration features in order to guarantee a continuous flow of data between the two.

Take into account the software’s integration capabilities and determine whether or not it offers support for integrations with the tools you are utilizing at the moment or intend to utilize in the near future. This connection removes the need for human data entry and ensures that information is correct and up to date across all of the different systems, which both increases efficiency and reduces the likelihood of mistakes.

6 Best Accounting Software for Small Businesses

Accounting software plays a crucial role in helping small businesses efficiently manage their financial processes. Here are six top accounting software options that cater specifically to the needs of small businesses:

Moneypex

Moneypex accounting software stands out as the most popular accounting software for small businesses, offering a comprehensive suite of features and tools that make financial management a breeze. It’s user-friendly interface and robust capabilities set it apart from other options, making it the top choice for businesses of all sizes.

Key Features and Tools

-

- Invoicing: Moneypex’s advanced invoicing features allow you to effortlessly create professional invoices tailored to your brand. Customize templates, add your logo, and send invoices with just a few clicks. Stay on top of your payments with real-time tracking and automatic reminders.

-

- Expense Management: Moneypex simplifies expense management by providing a streamlined system for tracking and categorizing expenses. Easily capture receipts using your mobile device and link expenses to specific projects or clients. With Moneypex, reconciling bank transactions and keeping accurate records has never been easier.

-

- Bank Reconciliation: Moneypex’s seamless bank reconciliation feature allows you to import bank transactions and reconcile them effortlessly. Ensure the accuracy of your financial records, identify discrepancies, and keep your accounts up to date.

-

- Financial Reporting: Generate comprehensive financial reports, including profit and loss statements, balance sheets, and cash flow statements. Gain valuable insights into your business’s financial health and make informed decisions to drive growth and success.

-

- Tax Management: Moneypex simplifies tax management by providing tools to calculate and file taxes accurately. Effortlessly submits VAT, generates tax reports, and allows you to be MTD compliant in UK. Say goodbye to the stress of tax season with Moneypex by your side.

-

- Smart Scanning: Its advanced feature allows you to extract information from handwritten or printed receipts and categorize them into multiple fields automatically.

-

- Inventory Management: Take control of your inventory with Moneypex’s efficient inventory management tools. Track stock levels, generate purchase orders, and gain valuable insights into your inventory performance.

-

- Collaboration: Collaborate seamlessly with your team grant specific access levels to team members, share financial data securely, and streamline communication for better efficiency.

Pricing Plans and Options

Moneypex offers a transparent pricing plan with affordable monthly or annual subscription options. The pricing is based on the selected plan and the number of users accessing the software.

User Feedback and Satisfaction

Moneypex receives positive feedback for its user-friendly interface and affordability. Users appreciate its ease of use, efficient invoicing features, and accurate reporting capabilities. The software’s simplicity and the ability to handle basic accounting without overwhelming complexity are often praised. However, some users have expressed a desire for additional integrations and more advanced features.

Moneypex’s unrivaled combination of advanced features, ease of use, and affordability positions it as the best accounting software for small businesses. With its robust capabilities, superior user experience, and comprehensive support, Moneypex empowers businesses to manage their finances effectively, make data-driven decisions, and thrive in today’s competitive landscape.

FreeAgent

FreeAgent is an accounting software specifically designed for freelancers, contractors, and small businesses. It offers a user-friendly interface and a range of features to streamline financial management.

Key Features and Tools

-

- Expense Tracking: Easily track and categorize expenses, upload receipts, and reconcile bank transactions.

-

- Time Tracking: Record billable hours and track project profitability.

-

- Bank Integration: Connect FreeAgent to your bank accounts for seamless transaction syncing.

-

- Tax Management: Calculate and file VAT returns, manage self-assessment, and generate tax estimates.

-

- Financial Reporting: Generate detailed reports, including profit and loss, balance sheets, and cash flow statements.

-

- Project Management: Manage projects, track time, and assign expenses to specific projects.

-

- Client Portal: Provide clients with access to their project details, invoices, and estimates.

Pricing Plans and Options

FreeAgent offers different pricing plans based on the size of your business and the features you need. They offer a monthly subscription model with pricing options for sole traders, partnerships, and limited companies.

User Feedback and Satisfaction

FreeAgent receives positive feedback for its user-friendly interface, automation features, and excellent customer support. Users appreciate its ease of use and the time-saving benefits it offers in managing finances. The software is well-regarded for its ability to simplify accounting processes for small businesses.

Zoho Books

Zoho Books is a cloud-based accounting software designed for small businesses. It provides comprehensive features to manage finances, automate tasks, and collaborate with clients.

Key Features and Tools

-

- Expense Management: Track and categorize expenses, capture receipts using a mobile app, and reconcile bank transactions.

-

- Inventory Management: Track inventory levels, create purchase orders, and generate reports on stock movements.

-

- Bank Reconciliation: Automatically import bank transactions and reconcile them with ease.

-

- Tax Management: Calculate and file taxes, including VAT and GST, and generate tax reports.

-

- Collaboration: Collaborate seamlessly with your team grant specific access levels to team members, share financial data securely, and streamline communication for better efficiency.

-

- Integration Capabilities: Seamlessly integrate with other Zoho applications and popular third-party tools.

Pricing Plans and Options

Zoho Books offers various pricing plans to cater to different business needs. They provide affordable monthly and annual subscription options, with features scaling based on the selected plan.

User Feedback and Satisfaction

Zoho Books receives positive feedback for its user-friendly interface, powerful features, and value for money. Users appreciate its integration capabilities, mobile accessibility, and extensive customization options. The software is highly regarded for its ease of use, especially for non-accountants.

QuickBooks Online

QuickBooks Online is a widely used cloud-based accounting software suitable for small businesses. It offers a range of features to simplify financial management and streamline business processes.

Features and Functionalities

-

- Expense Tracking: Categorize and track expenses, capture receipts, and automate expense reconciliation.

-

- Bank Integration: Sync bank transactions, automate bank reconciliations, and manage cash flow.

-

- Tax Management: Calculate VAT returns, manage self-assessment, and generate tax reports.

-

- Payroll Management: Run payroll, manage employee information, and handle payroll tax calculations.

-

- Integration with Third-Party Apps: Seamlessly connect with popular apps like Shopify, PayPal, and Square to streamline business operations.

-

- Time Tracking: Track billable hours, manage timesheets, and easily convert time entries into invoices.

-

- Multi-User Access: Collaborate with your team and grant specific access levels to different users.

-

- Mobile Accessibility: Access QuickBooks Online from anywhere using mobile apps for iOS and Android devices.

Pricing Plans and Options

QuickBooks Online offers several pricing plans to cater to businesses of different sizes and needs. They provide tiered subscription options with varying features and functionalities. Pricing plans often include a monthly or annual subscription fee.

User Feedback and Satisfaction

QuickBooks Online has a strong reputation and generally receives positive user feedback. Users appreciate its extensive features, ease of use, and ability to customize the software to meet specific business needs. The software’s reliability, customer support, and regular updates are also frequently praised.

Xero

Xero is a cloud-based accounting software popular among small businesses for its comprehensive features and user-friendly interface. It offers a range of tools to simplify financial management and promote collaboration.

Key Features and Tools:

-

- Invoicing and Payments: Create and customize professional invoices, send payment reminders, and accept online payments.

-

- Expense Tracking: Track and categorize expenses, automate expense reconciliation, and capture receipts using a mobile app.

-

- Bank Reconciliation: Automatically import bank transactions, match them with invoices and expenses, and reconcile accounts.

-

- Inventory Management: Track and manage inventory levels, create purchase orders, and generate inventory reports.

-

- Reporting and Analytics: Generate financial reports, including profit and loss statements, balance sheets, and cash flow statements.

-

- Payroll Management: Run payroll, calculate taxes, manage employee information, and handle compliance requirements.

-

- Integration Capabilities: Seamlessly integrate with various third-party apps, such as CRM systems and payment gateways.

Pricing Plans and Options

Xero offers flexible pricing plans designed to accommodate businesses of different sizes. They provide tiered subscription options with varying features and capabilities. Pricing is typically based on the number of users and additional add-ons selected.

User Feedback and Satisfaction

Xero is widely regarded for its intuitive interface, robust features, and strong customer support. Users appreciate its ease of use, automation capabilities, and ability to customize the software to fit their specific business needs. The software’s extensive reporting and collaboration features are also praised.

Wave Financial

Wave Financial is a free cloud-based accounting software targeted toward small businesses, freelancers, and entrepreneurs. It provides a range of essential accounting tools to simplify financial management.

Key Features and Tools

-

- Invoicing: Create customized invoices, track payment status, and send automatic payment reminders.

-

- Bank Reconciliation: Match bank transactions with accounting records and reconcile accounts effortlessly.

-

- Reporting and Analytics: Generate financial reports, such as profit and loss statements and balance sheets.

-

- Tax Management: Calculate and file taxes, including VAT and sales tax, and generate tax reports.

-

- Payroll Management: Handle payroll tasks, including calculating taxes, managing employee information, and issuing pay stubs.

-

- Collaboration: Invite your accountant or team members to collaborate on financial tasks and securely share information.

-

- Mobile Accessibility: Access Wave Financial on the go using the mobile app for iOS and Android devices.

Pricing Plans and Options

Wave Financial offers a unique pricing model where the core accounting features are available for free. However, they charge for additional services such as payroll processing and payment processing. Users can choose to add these services based on their business needs and pay the corresponding fees.

User Feedback and Satisfaction

Wave Financial is well-received by small business owners and freelancers for its free accounting software option. Users appreciate the simplicity and ease of use, particularly for basic accounting tasks. The free invoicing and expense tracking features, along with the ability to integrate with bank accounts, are frequently praised. However, some users have noted limitations in reporting capabilities and customer support compared to paid accounting software options.

Key Factors for Accounting Software Implementation

Planning the Implementation Process

To ensure the successful implementation of the best accounting software for small businesses, it’s essential to follow a comprehensive plan that outlines the implementation process. Before implementing the accounting software, create a comprehensive plan outlining the implementation process. Identify key milestones, allocate resources, and establish a realistic timeline. Consider factors such as data migration, system configuration, and staff training.

Data Migration and Setup

Efficiently migrating your existing financial data to the new accounting software is crucial. Ensure the software supports data import from your previous system and follow the recommended data formatting guidelines. Take the time to clean and organize your data before importing it to avoid any inaccuracies or inconsistencies.

Staff Training and Adoption

Proper training for your staff is essential to maximize the benefits of the accounting software. Conduct training sessions to familiarize your team with the software’s features, workflows, and best practices. Encourage active participation and provide ongoing support during the learning process. It’s important to address any concerns or questions your staff may have to ensure smooth adoption.

Ongoing Support and Maintenance

After the initial implementation, ongoing support and maintenance are necessary. Stay updated with software upgrades, bug fixes, and security patches provided by the software vendor. Regularly back up your data to prevent loss and ensure system stability. Monitor the performance of the software and promptly address any issues that arise.

Conclusion

Researchers at Riz Accountants thoroughly compared and analyzed various accounting software options available for small businesses in UK in 2023, it is evident that Moneypex stands out as the top choice. Moneypex is an all-in-one solution that provides small businesses with the capacity to successfully manage their financial activities. Its comprehensive features, user-friendly design, and affordable price make it an attractive option. Its sophisticated features for invoicing, cost monitoring, inventory management, and financial reporting make it a formidable tool for boosting efficiency and assuring precise financial management. Considering its exceptional performance and positive user reviews, Moneypex emerges as the best accounting software for small businesses in UK in 2023. By choosing Moneypex, small business owners can streamline their accounting tasks, gain better financial insights, and ultimately drive growth and success in their ventures.

ABOUT OUR CONSULTING

SOLUTIONS

- Company Formation

- Bookkeeping

- Payroll Services

- Online Self Assessment

- Management Accounts

- VAT Returns